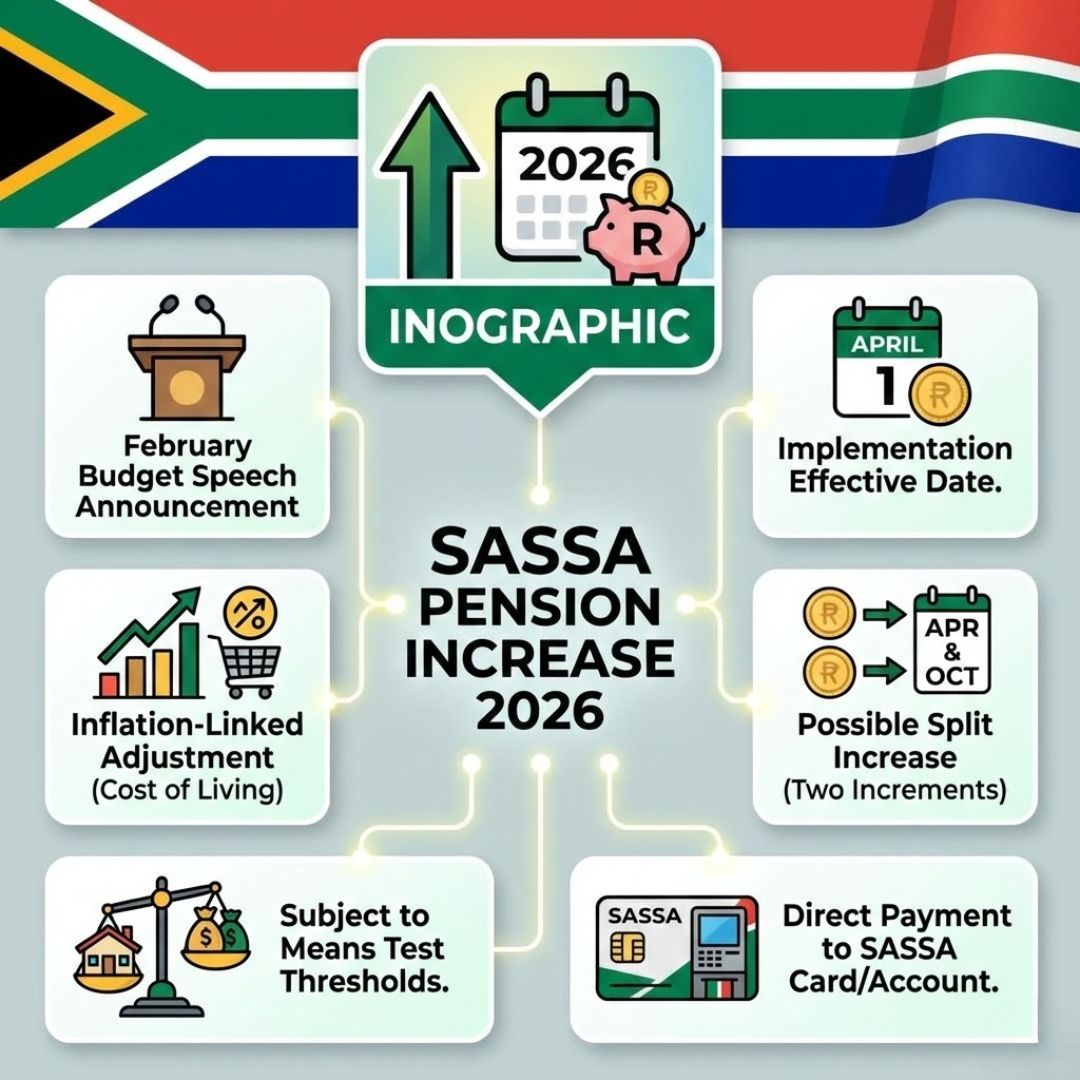

South Africa’s elderly population is set to receive meaningful financial relief in 2026 as the South African Social Security Agency (SASSA) confirms an increase in Old Age Pension payments. This update comes at a time when many pensioners are struggling to cope with rising costs for food, transport, electricity, and healthcare. For millions of older citizens, social grants remain their primary source of income. The government’s decision to raise pension amounts reflects an effort to protect vulnerable seniors. The increased payments will be applied automatically from February 2026, with no reapplication or additional paperwork required.

How the 2026 SASSA Pension Increase Will Affect Monthly Payments

Under the revised payment structure for the 2026 financial year, pensioners aged between 60 and 74 years will receive R2,315 per month. Beneficiaries aged 75 and older will receive a higher monthly amount, exceeding R2,500. This age-based adjustment recognises that older pensioners often face greater medical expenses and higher personal care costs. The updated amounts will be processed automatically within the SASSA payment system, ensuring that eligible beneficiaries receive the increase without needing to take any action.

Eligibility Requirements for Receiving the Higher Pension Amount

The pension increase will apply to all current beneficiaries as well as new applicants who qualify for the Older Persons Grant. To be eligible, applicants must be South African citizens, permanent residents, or officially recognised refugees. They must be at least 60 years old and pass the SASSA means test, which assesses income and assets. Existing grant recipients do not need to submit new documents. Approved new applicants in 2026 will receive the updated pension amount from their first payment.

2026 SASSA Pension Payment Dates and Payment Methods

SASSA has confirmed that Old Age Pension payments will continue to follow the official monthly payment schedule throughout 2026. Payments are usually made during the first week of each month, allowing pensioners to cover essential expenses such as groceries, electricity, and medication on time. Beneficiaries can receive their funds through direct bank deposits, SASSA cards, or collections at approved retail outlets. Reliable and timely payments remain critical, as many pensioners depend entirely on this income to manage their monthly living costs.

Retirement at 65 Ends?: South Africa’s New Age Rules and How Pension Payments Will Change Next

Retirement at 65 Ends?: South Africa’s New Age Rules and How Pension Payments Will Change Next

Why the 2026 Pension Increase Is Important for Older South Africans

For many elderly South Africans, the Old Age Grant is more than financial assistance—it is a lifeline. Pension income often supports entire households, including unemployed adult children and grandchildren. With the cost of living continuing to rise, fixed-income households face increasing financial pressure. While the 2026 pension increase may not fully offset inflation, it provides meaningful relief. It helps pensioners afford basic necessities and reduces financial stress, reinforcing the government’s commitment to protecting older citizens during challenging economic conditions.

SASSA Pension Increase 2026: Key Payment and Eligibility Overview

| Category | Details |

|---|---|

| Ages 60–74 | R2,315 per month |

| Ages 75 and above | Over R2,500 per month |

| Increase Start Date | February 2026 |

| Payment Methods | Bank account, SASSA card, approved stores |

| New Applicants | Updated amount applies from first payment |

What the Future Looks Like for SASSA Pensioners After 2026

The 2026 SASSA pension increase offers much-needed stability for older South Africans facing ongoing economic uncertainty. With automatic payment adjustments, reliable monthly schedules, and additional social support programs, pensioners can better plan their finances. However, beneficiaries are encouraged to keep their personal and banking details up to date with SASSA to avoid payment disruptions. Staying informed through official SASSA channels is essential. While challenges remain, the higher Old Age Pension represents a positive step toward safeguarding the dignity and well-being of South Africa’s elderly population.