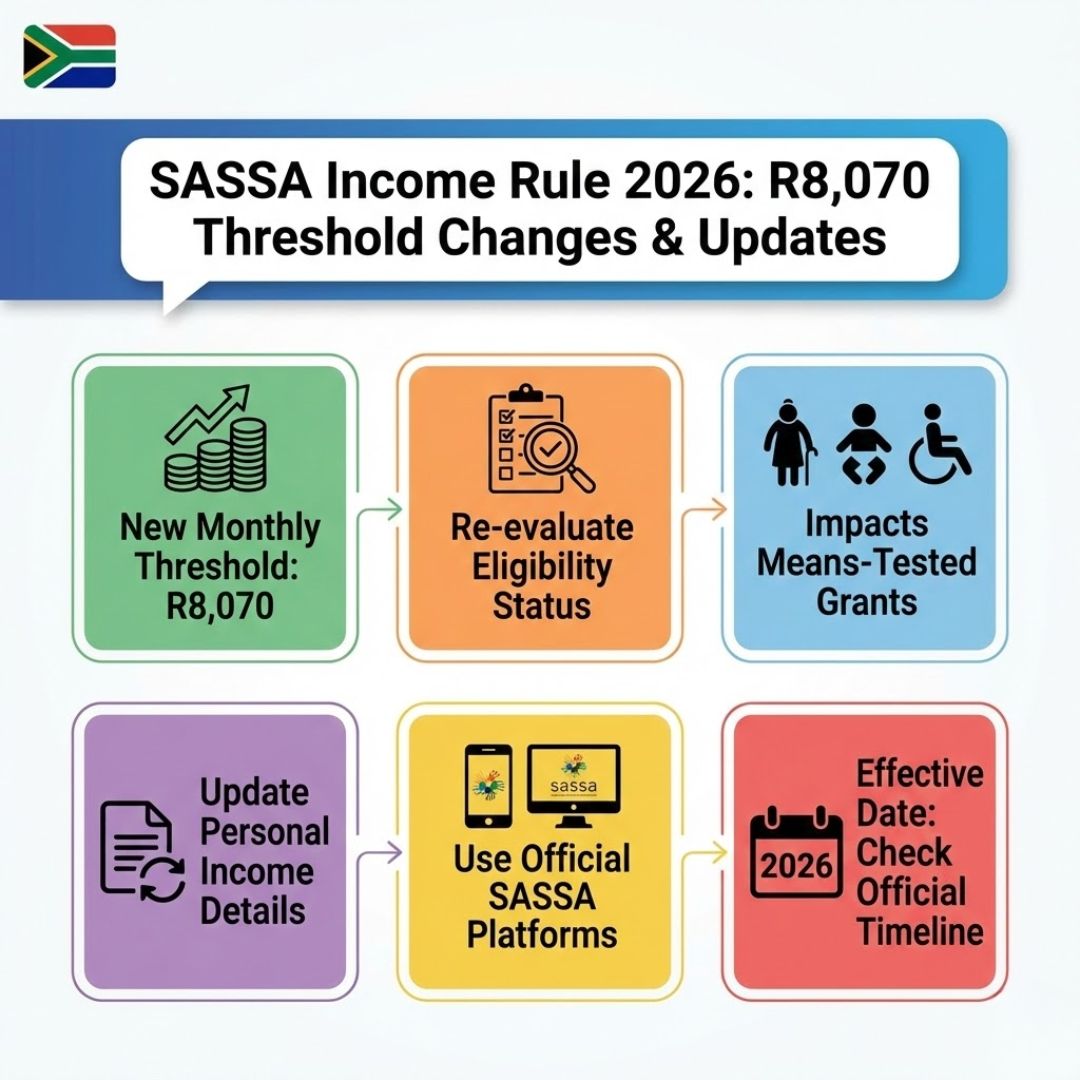

The South African Social Security Agency (SASSA) has announced a new income eligibility rule that will take effect in 2026. Under this updated regulation, social grant applicants and existing beneficiaries must earn less than R8,070 per month to qualify for assistance. The change is designed to ensure that social grants are directed toward households that need support the most, while also helping SASSA maintain the long-term financial sustainability of the grant system across South Africa.

How the R8,070 Income Threshold Works

According to the new rule, individuals whose total monthly income reaches R8,070 or more may become ineligible for SASSA social grants. The income assessment will include all regular sources of earnings, such as salaries from employment, informal work income, pensions, business earnings, and any other consistent financial support. If a reassessment shows that a household’s income exceeds the set threshold, grant payments may be reduced or completely discontinued.

Social Grants Covered Under the New Income Limit

The R8,070 income ceiling applies to all means-tested social grants administered by SASSA. These include the Older Person Grant, Disability Grant, Care Dependency Grant, and the Child Support Grant. Beneficiaries receiving these grants must meet the revised income criteria to continue qualifying. The updated threshold is expected to have a greater impact on households with multiple income earners, where combined earnings may push total income above the limit.

Stricter Income Checks and Verification From 2026

To enforce the new income rule, SASSA will introduce stricter income verification measures starting in 2026. Beneficiaries may be required to submit supporting documents such as bank statements, payslips, employer confirmation letters, or sworn affidavits. Failure to provide accurate and up-to-date financial information could result in the suspension or cancellation of grant payments.

What This Means for Current Grant Recipients

Existing SASSA beneficiaries will not lose their grants automatically under the new regulation. However, their financial circumstances will be reassessed using current income information. The revised income threshold mainly affects recipients whose earnings have increased since their original approval. SASSA advises beneficiaries to regularly review and update their income details to avoid unexpected disruptions to grant payments.

Steps Beneficiaries Should Take

Grant recipients are encouraged to calculate their total household income and ensure that all personal and financial information is accurate and up to date with SASSA records. Any changes should be reported through official SASSA offices or approved online platforms. Individuals who expect their income to exceed the threshold should prepare for possible benefit adjustments and consider alternative support options if needed.

The Purpose Behind the R8,070 Income Rule

SASSA introduced the R8,070 income threshold to improve fairness and efficiency within the social grant system. By tightening eligibility requirements, the agency aims to ensure that limited resources are directed toward South Africa’s most vulnerable households, while managing the growing demand for social assistance in a sustainable manner.

R8,070 Income Rule 2026 – Key Overview

| Category | Details |

|---|---|

| New Income Limit | R8,070 per month |

| Effective Year | 2026 |

| Grants Affected | Older Person, Disability, Care Dependency, Child Support |

| Income Sources Considered | Salary, informal work, pensions, business income |

| Verification Requirements | Bank statements, payslips, affidavits |