As major changes are made to how and when people can get their pension benefits, South Africa is entering a new era of retirement planning. The headline change, which is often called “Goodbye to 65,” means that the traditional retirement age and the way social support is set up will be very different in 2026. These changes are meant to protect people’s social safety net while also keeping the economy stable and dealing with longer life expectancies and economic pressures. For millions who depend on state and workplace pensions, it’s important to understand these changes so they can make smart, confident choices about their money in the future.

South Africa’s retirement age reform goes beyond 65

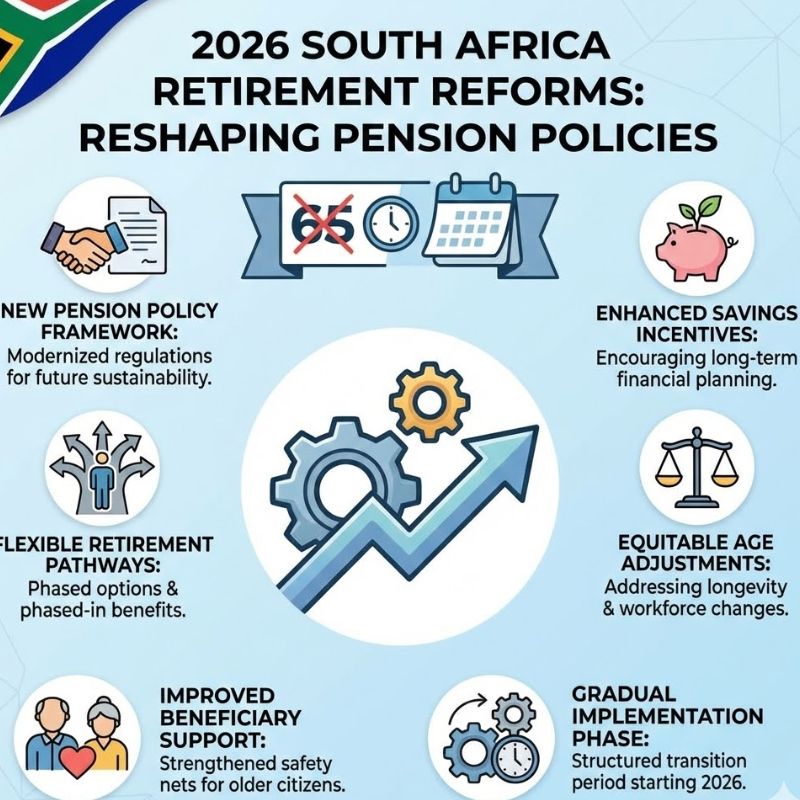

The most talked-about part of the 2026 reform is the slow move away from a set retirement age of 65. Policymakers are making the retirement window more flexible, so some workers can retire earlier or later depending on their contributions and the rules of their sector. This method takes into account the fact that people are living longer and tries to keep the pension system stable over the long term. The new structure gives many employees phased retirement options, which encourages them to work part-time before they retire completely. At the same time, officials stress how important it is to have financial sustainability goals so that state resources are still available for future generations of South African retirees.

Changes to Pension Policies in the 2026 South African Framework

The new framework makes sure that South Africa’s pension policies are in line with other economic changes. The government is making means tests stricter so that benefits go to the people who need them the most. Changes to the contribution credit system also reward people who stay in the workforce longer. Updated compliance standards must now be followed by employers and pension funds. This makes reporting and transparency better. These changes are related to a new benefit structure for retirees that balances monthly payments with the long-term health of the fund. This helps protect both current and future beneficiaries.

How the New Retirement Rules Will Affect Workers in South Africa

The changes give South African workers more chances and more responsibilities in their daily lives. Employees are urged to look over their personal savings plans and talk to financial advisors about when to retire. The government has put in place transition protection measures for people who are close to 65 so that they are not unfairly disadvantaged. At the same time, younger workers might benefit from longer contribution periods that boost their eventual payouts. Overall, the changes are meant to make people’s incomes more stable in old age while also adapting to changes in the workforce and population.

What This Means for the Future of Pensions

The pension changes in 2026 will be a big change for South Africa’s retirement system. Moving past a strict age limit shows that people are more aware of how work patterns are changing and how long people are living. Some people may not be sure at first, but the focus on flexibility and accountability could make the system stronger in the long run. The government wants to build public trust and ease the long-term strain on state finances by combining targeted support with responsible fiscal planning. Individuals will need to be aware of and plan ahead in order to successfully navigate this new retirement environment.

| Reform Area | Old Rule | 2026 Update | Who Is Affected |

|---|---|---|---|

| Age of Retirement | Set at 65 | Flexible time frame for retirement | All workers in the formal sector |

| Means Testing | Check of standard income | More strict eligibility review | People who want a state pension |

| Credits for Contributions | Few late incentives | More rewards for longer work | Active contributors |

| Help with the Transition | Few protections for near-retirees | Support for workers over 60 | Workers close to retirement |

| Structure of Benefits | Monthly payment as usual | Balanced long-term model | Current and future retirees |

Common Questions (FAQs)

1. What is the new retirement age in South Africa for 2026?

The reform replaces the strict retirement age of 65 with a more flexible window.

2. Will people who are already retired lose their pension benefits?

No, retirees who are already retired will still get payments under protected transition rules.

3. Are the new pension rules changing the way means tests work?

Yes, eligibility reviews are getting stricter so that support can be better targeted.

4. What can workers do to get ready for the changes to retirement?

Look over your savings plan, check your contribution records, and get help from a professional with your finances.