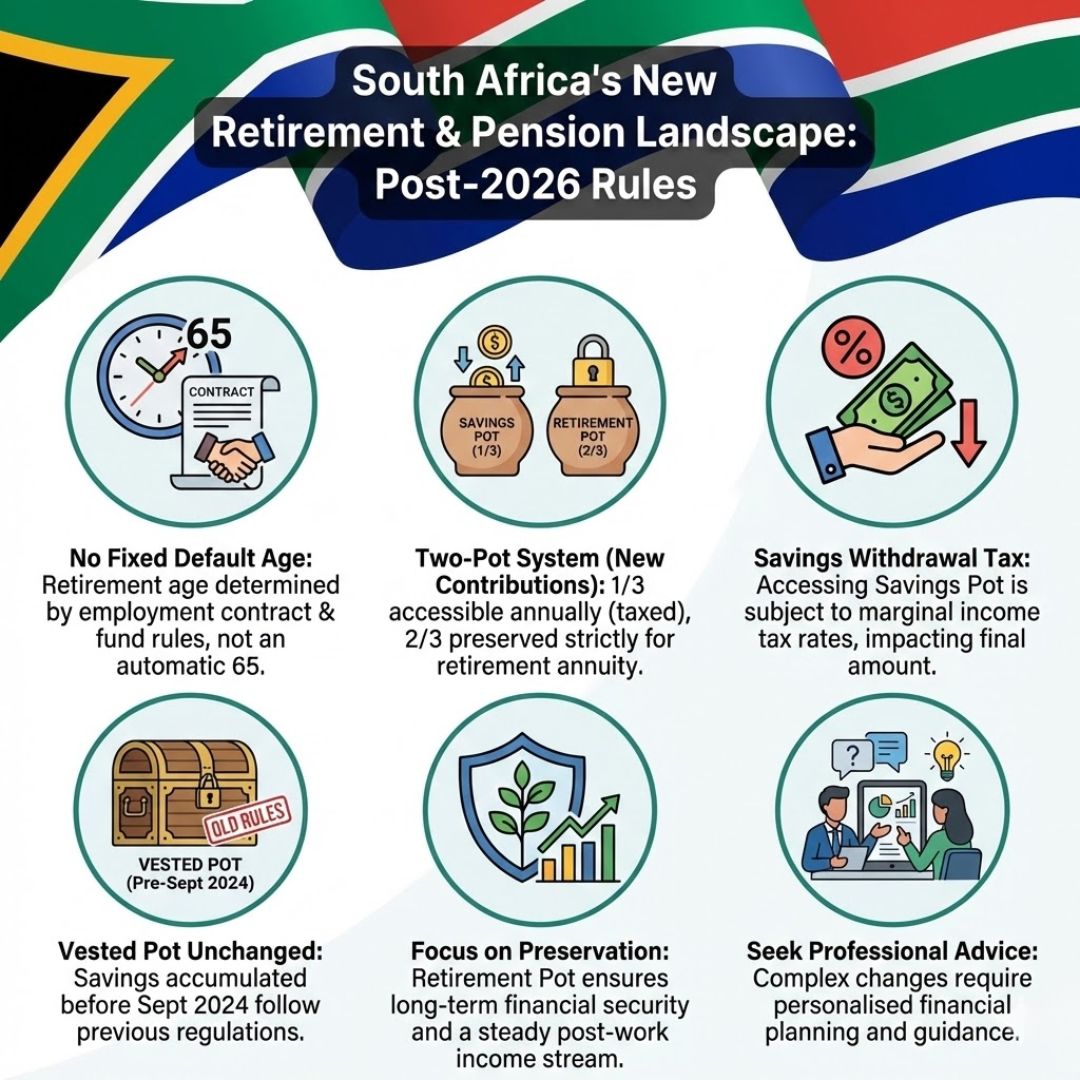

South Africa’s Changing Retirement Age: What You Need to Know The old idea that South Africans must stop working at 65 is starting to fade away. New pension rules and employment laws are changing how people think about retirement. Several factors are pushing this shift forward including money worries and the fact that people are living longer than before. The job market is also changing in ways that make flexible retirement ages more practical. Both government officials and business leaders are taking a fresh look at mandatory retirement ages. The traditional system forced workers to leave their jobs when they hit 65 regardless of whether they wanted to continue working. This one-size-fits-all approach is being replaced by something more flexible.

Why the Retirement Age Is Being Changed

Health improvements and longer lifespans are the main reasons for this change. Older people today live longer and stay healthier throughout their lives. Someone who retires at 65 and lives for another forty years will need to have saved a large amount of money through savings accounts and pension plans. Building up this amount becomes extremely difficult when the cost of living is high. Rising expenses for food and housing and healthcare have shown how many working years people need to achieve financial stability for retirement.

How Flexible Retirement Options Are Expanding for Workers

Employees no longer have to leave their jobs at a fixed retirement age. They can keep working past 65 if both the employer and employee agree. This new way of keeping older workers employed helps the government maintain enough skilled workers in the labor market. It also lets older people earn more money and build their retirement savings while they stay active in mentoring younger employees. Some employers now offer gradual retirement plans or part-time hours or consulting roles to support older workers without wearing them out.

SASSA Pension Increase 2026: What South African Pensioners Can Expect to Receive in the Coming Year

SASSA Pension Increase 2026: What South African Pensioners Can Expect to Receive in the Coming Year

How the New Retirement Age Affects Pension Planning

People get better pension results when they work for more years. Working longer gives retirement savings more time to grow and can lead to bigger monthly pension checks after retirement. But people who want to retire early can still do that even though it usually means getting smaller benefits. Knowing the rules about pension funds and how contributions work matters more than ever.

What This Change Means for People Approaching Retirement

A new system offers greater flexibility for individuals nearing the age of 65. People who have adequate financial resources or face health challenges can retire at the conventional retirement age. Those who prefer to work beyond this point can do so to strengthen their financial position. Successful retirement planning requires thoughtful consideration of income needs alongside personal lifestyle preferences & long-term financial stability.

How Younger Workers and the Job Market Are Impacted

There has been worry about whether older people working longer would stop young South Africans from finding jobs. However many employers think that having workers of different ages helps the company and creates better supervision along with knowledge transfer and steadiness. Older workers with experience offer important expertise while younger staff members bring new ideas and modern approaches.

How to Prepare for the New Retirement Landscape

The concept of retirement has evolved significantly in recent years. South Africans must therefore review their financial strategies and make necessary adjustments well in advance. Consulting with professionals and keeping up to date with policy changes is essential. Those who embrace the increasingly flexible retirement framework are likely to make smarter choices & enjoy greater financial security in their later years.